Investing in Japan: Menicon, a leading Japanese contact lens manufacturer, aims overseas market expansion

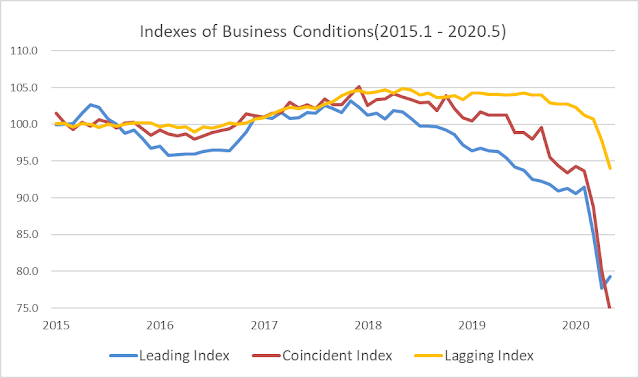

Menicon secured profit growth amid COVID-19 disruptions Menicon Co., Ltd. is a leading contact lens manufacturer in Japan founded in 1951, headquartered in Nagoya. It consistently develops, manufactures and sells contact lenses and related products in-house. To date, Menicon has developed various types of contact lenses such as hard lenses, soft lenses, disposables (disposable), lenses for astigmatism and bifocal lenses. It has the No. 1 market share for hard lenses and the No. 2 market for soft lenses in Japan. As for the recent consolidated financial results, Menicon announced that net income for the fiscal year ended March 31, 2020 was 4 billion yen, up 14% from the previous year. While the sales and profits of most Japanese companies fell sharply due to the spread of new coronavirus infections, Menicon increased its sales by 4.5% from the previous year to 84.5 billion yen, a record high for the fifth consecutive year since listing of its stock. On the other hand, the earning...