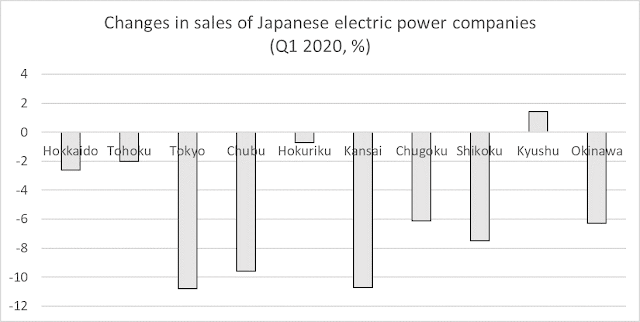

Investing in Japan: Electric power demand indicates economic circumstances

Investors may infer some implications in data from Electric power companies The spread of new coronavirus infections has affected economic activities in various ways. In particular, prevention measures to contain the virus such as suspension of factory operation and refraining from going out decreased demand for electricity. Stagnant activities in the industrial and business sectors are promptly reflected in electricity demand. That is why data of electricity demand is considered to be useful information to analyze economic situation. From this perspective, let’s take a look at consolidated financial results of large Japanese electric power companies for the April-June 2020 period announced by them at the end of July. According to the announcement by ten major Japanese electric power companies, the demand for electric power decreased and sales fell for all but one. As for incomes, operations in restaurants and factories were slowed leading to decreased profit for four out of ten