Investing in Japan: Electric power demand indicates economic circumstances

Investors may infer some implications in data from Electric power companies

The spread of new coronavirus infections has affected economic activities in various ways. In particular, prevention measures to contain the virus such as suspension of factory operation and refraining from going out decreased demand for electricity.

Stagnant activities in the industrial and business sectors are promptly reflected in electricity demand. That is why data of electricity demand is considered to be useful information to analyze economic situation.

From this perspective, let’s take a look at consolidated financial results of large Japanese electric power companies for the April-June 2020 period announced by them at the end of July.

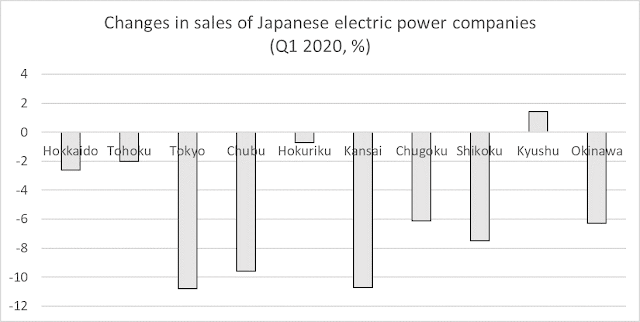

According to the announcement by ten major Japanese electric power companies, the demand for electric power decreased and sales fell for all but one. As for incomes, operations in restaurants and factories were slowed leading to decreased profit for four out of ten companies.

For example, one of the largest, Kansai Electric Power, has its net profit for the period to down 21% year-on-year. Sales decreased by 23 billion yen and ordinary income decreased by 11 billion yen due to reduced electricity demand at hotels, entertainment facilities and automobile factories in its business area.

Chubu Electric Power also saw a 62% fall in profits due to a 30%

decrease in power demand from automobiles and steel industries. For those

reasons, the stock prices of electric power companies were sluggish in July and

August.

Global market may be supported by monetary and fiscal policies

On the other hand, monetary and fiscal policies are expected to support stock markets globally and stock prices may not further depreciate in the Tokyo market. Numerous support measures by the Japanese government and the government’s stance not to declare another state of emergency this time may also help to reduce negative impact on economic activities caused by COVID-19.

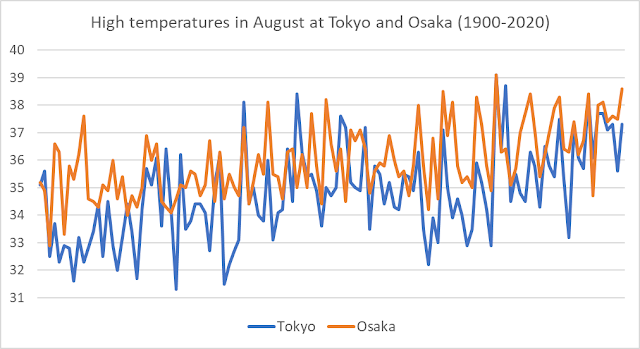

In addition, extreme scorching heat wave tied for a national record in this summer may increase electricity consumption. Rising temperature seems to be long lasting trend also in Japan. Japanese investors may consider the market is bottoming out if energy demand starts to increase.

Electric

power companies may also be reevaluated as stable investment destinations by

investors if their stock prices keep falling further considering the decline in

profits of electric power companies was relatively limited in the April-June

period compared to other Japanese companies in which some have lost their

profit completely.

Comments

Post a Comment