Smartphone businesses expand in Japan taking advantage of the legal revision.

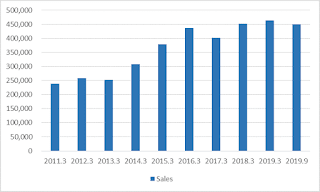

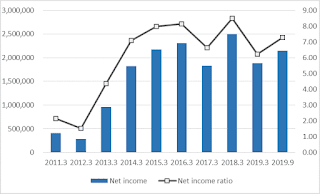

Used smartphone market in Japan Used smartphone market is expected to grow further in 2019 because the law related to telecommunications has been revised on October 1, changing the used smartphone market in Japan. Japanese smartphone market is smaller than other countries although it is gradually expanding. Unit sales of used terminals have been in the upward trend. The smartphone sold annually is estimated to top 3 million units by 2020. However compared to new products sales, sales of second-hand smartphones are still small, and it is significantly lower than that of the United States, Germany and France. It is analyzed that Japanese consumer is not aware of the cost efficiency of the used smartphones that is the greatest attraction of used products. A majority of consumers of big Japanese telecommunication carriers, namely Softbank, NTT DoCoMo and KDDI pay the terminal charges in monthly installments. They pay the monthly payment for the terminals with communication c