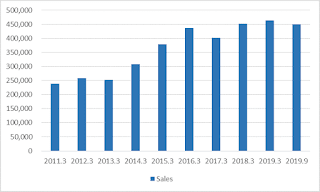

NGK's financial results show strong demand for its products remains although sales decline

According to NGK's financial results for the second quarter of the fiscal year ending March 31,

2020, net sales were expected to fall 3.7% year on year to 219,766 million yen and net income to decline 14.0% to 21,244 million yen.

Slowing demand of insulators for electric

power businesses due to restrained capital investment by domestic power

companies and intensified competition overseas in addition to decreasing shipments

of NAS batteries pushed down its results.

On the other hand, in the ceramics

business, one of the company's main businesses, sales of the GPF (Gasoline

particulate filter) for gasoline passenger cars increased because of the

stricter emission regulations in Europe and China although the shipment of ceramic

catalyst carriers for automobile exhaust gas purification (HONEYCERAM) decreased

due to the global decline in passenger car sales.

Sales of sensors also

increased. Other elements having negative influence on the company’s results

were delays in market recovery due to US-China trade friction and restrained

capital investment by semiconductor manufacturers.

As for sales by the segments,

the electric power business decreased by 14.7%, the ceramics business increased

by 4.5% the electronics business decreased by 6.6% and the process technology

business decreased by 16.0%. For the full-year forecast, sales are expected to

decline by 3% to 450 billion yen.

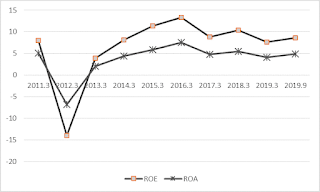

However its efficiency remains as the chart

below shows and the company continue to provide us great investment

opportunities.

Comments

Post a Comment