Stock Market Update: Tokyo Electron shows resilience, Toyota and Honda falls on weaker dollars.

Tokyo stocks closed sharply lower on July 31 with the benchmark Nikkei index falling for 6 days in a row to 21,710 yen, down 629 yen. It was nearly 3 percent drop to its lowest level since June as selling spread across the board on stronger yen and weak earnings amid the coronavirus pandemic. The Nikkei Stock Average has fallen below 22,000 yen for the first time in almost a month since June 29.

Dozens of Japanese companies have announced poor financial results for the April-June period of 2020, feeding investor’s anxiety about corporate performance. The accelerating yen's appreciation against US dollar also became a burden on exporting companies. In the Tokyo foreign exchange market, US dollar was traded up to 104.20 yen on the day for the first time in about four and a half months.

The US Gross Domestic Product preliminary figures falling the largest ever was another concern for investors about the future outlook of the US economy. Japanese investors were once again made aware of the devastating impact of the new coronavirus on the economy.

On the other hand, there are strong expectations among investors that monetary and fiscal policies by governments globally will provide support to the stock market and it may recover to 22,000 yen next week. The price decline below 22,000 yen may trigger bottom picking preventing the market from falling further. However, if the number of newly infected cases continue to increase in Japan, state of emergency is probably declared again.

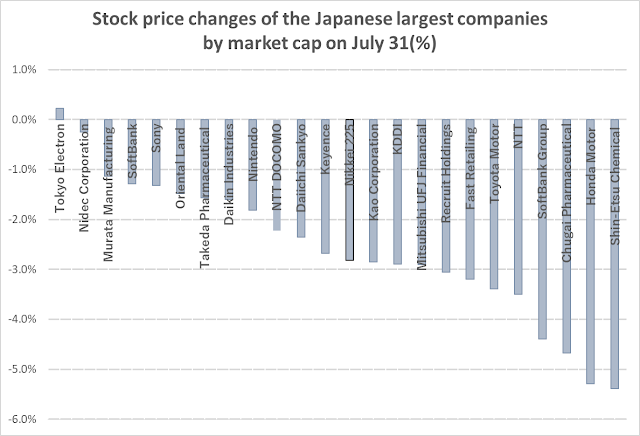

Investors are watching closely

how those situations will develop. The stock price changes (%) on July 31 of

the Japanese largest companies by market value are as follows.

Toyota Motor Corp. -3.39

SoftBank Group Corp. -4.39

Keyence Corp. -2.68

Sony Corp. -1.38

Nippon Telegraph and Telephone Corp. -3.50

NTT Docomo Inc. -2.22

Chugai Pharmaceutical Co., Ltd. -4.67

KDDI Corp. -2.89

SoftBank Corp. -1.29

Nintendo Co., Ltd. -1.82

Fast Retailing Co., Ltd. -3.20

Recruit Holdings Co., Ltd. -3.06

Daiichi Sankyo Co., Ltd. -2.35

Takeda Pharmaceutical Co., Ltd. -1.57

Mitsubishi UFJ Financial Group, Inc. -2.91

Daikin Industries, Ltd. -1.60

Shin-Etsu Chemical Co., Ltd. -5.39

Honda Motor Co. -5.29

Oriental Land Co., Ltd. -1.48

Tokyo Electron Ltd. 0.23

Comments

Post a Comment