TIA Co., Ltd. expands its business as Japanese society rapidly ages.

TIA Co., Ltd. in the aging Japanese society

TIA Co., Ltd. headquartered in Nagoya City, Aichi Prefecture provides funeral services mainly in the Chubu region taking advantage of aging Japanese demography.

Japan's elderly population over 65 reached 35.88 million, accounting for 28.4% of the total population. As society ages, the number of people died in 2017 is expected to have been 1.6 million, about 15% higher than 10 years ago.

TIA is expanding its business with 116 funeral halls under its management as of the end of October 2019 mainly in the Chubu region. Of these, 59 halls are directly managed by the companies and 48 are franchised halls.

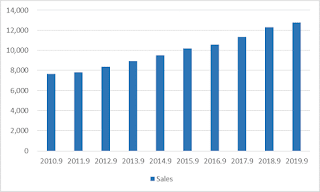

TIA has kept expanding its sales and financial stability with funerals held annually increasing as Japanese society ages.

On the other hand, the average number of attendees to funerals held at Tia halls has dropped to 35, about a quarter compared to 10 years ago. In accordance with the decrease in attendance, funeral cost has fallen by about 15%.

For this reason, TIA regards that doing business at large venues is not profitable and has started building smaller halls for “family funerals” that only invite relatives and close acquaintances.

In recent aging society, more people die more than ten years after their retirement. As a result, they lose close relationships with colleagues at their companies, causing less attendees to funerals.

Furthermore, the number of relatives continues to decrease as birthrate declines. TIA expects funeral attendees will continue to decline as family members and funeral attendees continue getting smaller. It leads to less funeral expenses although more funerals will be held with the society aging.

To cope with these circumstances, TIA established four basic strategies, namely “clarification of funeral expenses with a clear pricing system”, “improvement of services through enhanced human resource education”, and “boosting convenience through a dominant presence”, and “implement a thorough differentiation strategy”.

As for financial results in the fiscal year ending September 30, 2019, net sales were 12,791 million yen (up 3.8% from the previous fiscal year), net income was 791 million yen (down 11.7%) influenced by increasing cost such as personnel expenses and advertising expenses.

Looking ahead, TIA aims to grow further with its medium- to long-term target to manage 200 halls.

Comments

Post a Comment