Denso provides attractive return with its good financial standing despite of decreasing sales

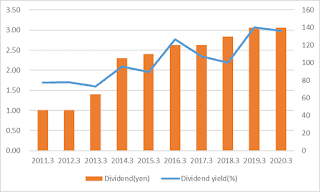

DENSO has been maintaining high dividend

On January 31, Denso Corporation has announced its consolidated financial forecast for the fiscal year ending March 31, 2020.Net income is expected to decrease by 12% to 225 billion yen, revised downwardly by 32 billion yen from the previous forecast.

Additional costs of 42 billion yen for the recall of completed vehicles dragged down its income. Sales in China, India and elsewhere have also slowed down.

Sales are expected to decrease by 2% to 5,260 billion yen, and operating profit to decrease 11% to 280 billion yen.

Among the eight major Toyota group companies including Denso, five companies posted declining profits for the April-December quarter of FY2019 due to the slowdown in the Chinese market and investment cost in developing autonomous driving system.

In addition, Toyota group companies have suspended operations at the Chinese plants in response to novel pneumonia, and are expected not to resume their operation until February 10. If this effect is prolonged, business results will be hurt further.

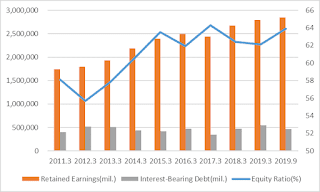

Despite these hardship, DENSO’s solid finance accumulated so far enable the company to maintain high dividend.

The recent slump in the stock price may provide long term investors with an attractive investment opportunity on DENSO which has both excellent technological and financial strength.

In addition, an executive of group companies has analyzed that the Chinese market may bottom out in the near future because orders from local manufacturers are increasing.

Comments

Post a Comment