Investing in Japan: Kansai Electric Power diversifies its growth strategy

Some Japanese electric power companies provide good and stable dividends

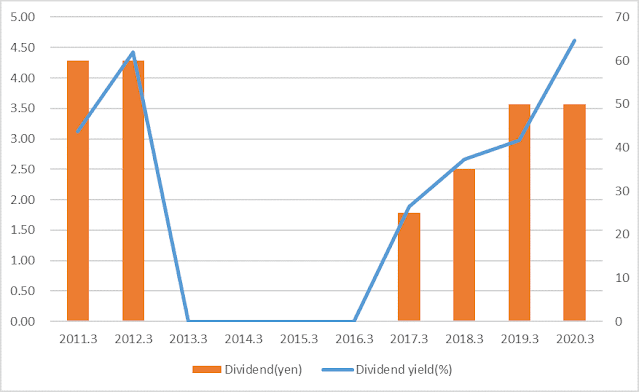

Japanese electric power companies have long been prime investment destinations for Japanese individual investors because of their generous dividends. However, after the Great East Japan Earthquake in March 2011, those electric power companies lost its status as their profits and financial bases were deteriorated due to the suspension of the nuclear power plant and soaring fuel prices forcing them to reduce or abolish dividends.

Their stock prices have plummeted and left irrationally low since then. But recently, some electric power companies have improved their financial bases and increased dividends close to that of before the earthquake. However, their stock prices are left fairly low, so the yields of them are surprisingly high.

Before the earthquake, electric power companies have never decreased dividends even in difficult times economically. That is why some Japanese investors expect stable return from investment in electric power companies once they recover high yield dividends.

One of them is Kansai Electric Power Co., Inc. which has begun to improve its financial base by restarting the four nuclear power plants. The company will also proceed with the decommissioning of the four aging nuclear power plants over the next 30 years.

As for decommissioning costs which are concerned to worsen its business performance over the long term, Kansai Electric Power has announced a forecast of more than 180 billion yen in total. Most investors seem to have finished taking those associated costs into account deciding their investment strategies.

The second largest power company provides investors with almost 5% yield

Kansai Electric Power Co., Inc., established in 1951, is the second largest power company in Japan whose main business area is the Kansai region. Major cities such as Osaka, Kyoto and Kobe are included in the region making it the second largest metropolis next to Tokyo area.

Although Kansai Electric Power has its business base mainly in the Kansai region, it also supplies electricity to some cities and towns in the Chubu region. As other Japanese electric power companies, Kansai Electric Power almost monopolizes the power supply in the Kansai region, but the amount of electricity the company supplies has been decreasing due to intensifying competition among energy companies on the backdrop of the recent power liberalization and shrinking Japanese population.

As for the consolidated financial results for the fiscal year which ended on March 31, 2020, sales decreased by 4% from previous term to 3,184.2 billion yen. Sales of electric power business decreased by 6% due to warm winter and the price reduction of electricity charges in July 2018. Net income was 130.0 billion yen, up 13% from the previous fiscal year, thanks to decreasing fuel costs brought by the recent decline in crude oil prices and the increase in gas sales of its affiliated company.

As other electric power companies, stock price of Kansai Electric Power is extremely low resulting in its high dividend yield of almost 5% as of June 2020, which is very generous as Japanese companies. On the other hand, the forecast of business results for the fiscal year ending March 2021 was not disclosed because the impact of the spread of new coronavirus infection cannot be predicted.

Aiming to new strategy in low-carbon society

As competition for the shrinking domestic market intensifies, Kansai Electric Power is expanding its wind power business off the coast of England and Finland. It also announced that it will establish two new hydroelectric power plants in Hida City, Gifu Prefecture, to secure annual power generation equivalent to approximately 9,300 ordinary household consumption in Japan.

Kansai Electric Power will continue to develop overseas businesses and diversify its power supply composition in preparation for the coming low-carbon society as part of its future growth strategy.

Comments

Post a Comment