Investing in Japan: Konica Minolta could be a good investment destination for value investors

Konica Minolta has suffered shrinking sales due to COVID-19

Konica Minolta, Inc. manufactures multi-functional peripherals, laser printers, digital color printing systems, inkjet print heads and inks, as well as print and cloud services.

It is one of the largest Japanese electronics companies with more than 44,000 employees in its group. Although Konica Minolta is headquartered in Tokyo, it has also expanded production bases in the Chubu region such as Toyokawa City, Aichi Prefecture.

As the demand for printing at offices is decreasing due to the spread of new coronavirus infection, Konica Minolta has been facing the challenge of shrinking sales and seeking new strategy to secure revenues by providing services and products other than office equipment.

For this reason, the company is expanding services connecting office related products with servers and software to support the IT conversion of companies by providing multifunction devices, IT services, and IT maintenance and operation.

Konica Minolta is expanding provision of ICT services

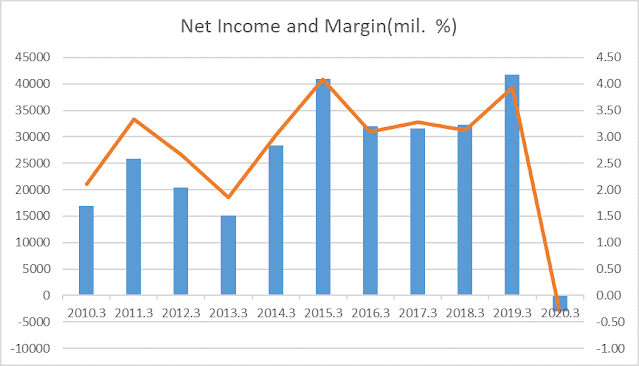

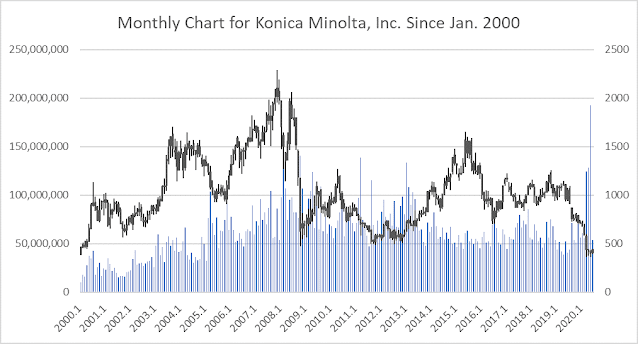

Recently Konica Minolta's stock price has plummeted to the almost lowest level in two decades because of recent terrible financial results. Its consolidated net sales are stagnant at 996.1 billion yen for FY2019 (down 6.0% year on year).

Sales of office products decreased in China and North America due to the spread of the new coronavirus. For Konica Minolta, whose sales outside Japan accounts for 80%, the global spread of infection was a major blow causing the final loss of 3 billion yen.

The company estimates that the impact of new coronavirus infections on consolidated sales reached around 23 billion yen. The impact of infections from April to June is expected to be greater than that of January to March.

As economic activities have resumed, the second wave is concerned and situation will remain unpredictable for the time being. For this reason, the company could not disclose forecast of its financial results for March 2021.

With medium-term perspective that its mainstay business manufacturing office related equipment cannot avoid the effects of decreasing printing volumes, Konica Minolta is expanding the provision of ICT services for new working styles such as remote work where demand is expected to grow after the outbreak.

In addition, Konica Minolta also receives high evaluation in bio-healthcare field for its genetic testing technology and will increase further the number of testing contracts. Konica Minolta has incurred profit plunging brought by COVID-19 now, but it may turn those difficulties into opportunities to grow further. If so, Konica Minolta will be a great investment destination for value investors.

Comments

Post a Comment