Investing in Japan: ICHIBANYA is a Nagoya originating curry specialty restaurant certified by the Guinness World Records as the largest

ICHIBANYA boasts incredible profitability although tarnished by COVID-19 infection

ICHIBANYA CO., LTD. has been operating and franchising curry specialty restaurants "Curry House CoCo Ichibanya", known as "CoCoICHI" which is a chain restaurant specializing in Japanese-style curry rice. ICHIBANYA has continue to expand its business not only in Japan but also in Asian countries, the United States, the United Kingdom and others for more than 40 years since its establishment in 1978.

Headquartered in Ichinomiya City, Aichi Prefecture, it operates 1,484 restaurants as of September 2020. ICHIBANYA started its business with a small coffee shop opened in Nagoya by its founder and has grown dramatically in a short period of time, becoming a curry specialty store that everyone knows in Japan. Furthermore, it has expanded its business scale so remarkable that was certified by the Guinness World Records as the largest curry restaurant in the world in 2013.

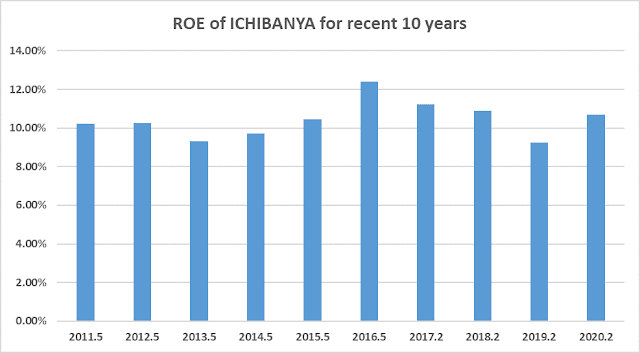

The fact that ICHIBANYA keeps ROE around 10 % shows its incredible profitability considering the average ROE of Japanese large companies listed on Tokyo stock exchange’s first section is around 6.7% in FY 2019. However even ICHIBANYA’s efficient operation could not stave off incurring subdued sales caused by COVID 19.

As for recent financial results, its sales and revenues were stagnant due to the effects of the new coronavirus infection. In the second quarter to August 2020, sales were 21,460 million yen (down 16.4% year-on-year), operating income was 1,070 million yen (down 64.3%), ordinary income was 1,240 million yen(down 59.9%) and net income was 678 million yen (down 64.5%).

ICHIBANYA faces a

difficult business environment and declining sales as other restaurants and

food service industry in Japan because local governments request them to

refrain from business in an effort to contain the infection while companies shift

to teleworking and inbound demand disappears.

Overseas business is expanding and helps the company to recover

On the other hand, for the full year forecast to February 2021, the situation is expected to improve thanks to a brisk home delivery service and recovery of overseas business. Consolidated net income for the fiscal year ending February 2021 was previously forecasted to decrease 67% to 1 billion yen, but the latest forecast was upgraded to 1.7 billion yen, a 46% decrease from the previous fiscal year.

The increase in sales of a home delivery service, take-out food utilizing delivery services such as Uber Sweets and receiving orders through internet also contributed the revenue improvement. Sales changes year on year have bottomed out gradually since April 2020. In addition, sales at overseas restaurants such as China and Taiwan recovering more than expected contribute to its profits.

In August 2020, ICHIBANYA opened its first store in India, the birthplace of curry, and started business development in the market with a huge population of about 1.3 billion. It also established ICHIBANYA International USA INC. in California, to actively promote further overseas business expansion.

As for the stock valuation of ICHIBANYA, now trading at more than 90

times of P/E ratio and dividend payment of 1.55%, it seems to be overpriced.

However, it may show Japanese investor’s expectation for the company’s future

growth. They will keep scrutinizing monthly sales data the company announces to

find clues of ICHIBANYA’s resilience against the pandemic for the coming

months.

Valuation Metrics (As of Dec 11, 2020)

Market Cap: 162.503 billion yen

The price-to-earnings ratio: 92.38

Price-to-book ratio: 5.36

Trailing Annual Dividend Yield: 1.57%

Comments

Post a Comment