Japan’s Economy: A tug of war between COVID-19 resurgence and strong export over economic recovery

Tourism industry, retailers and restaurants were hit again by the pandemic

The new coronavirus infections in Japan continue to spread. On January 13, the government issued the state of emergency again in 11 prefectures, including Tokyo and neighboring three prefectures. The pandemic is causing great damage to the tourism industry, one of Japan's major industries.

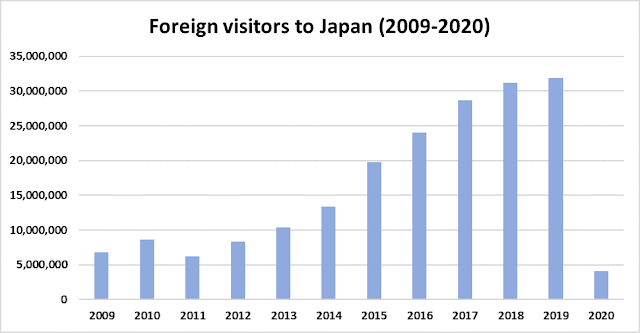

The Japan National Tourism Organization announced that the number of foreign tourists visiting Japan in 2020 was 4,115,900, a decrease of 87.1% from the previous year. It was the lowest level since 1998, and the rate of decline was the largest since 1964 when the statistics began. In particular, the number of foreign tourists in April has decreased by 99.9% from the previous year after the first state of emergency was declared, and has continued to decline for four consecutive months by the same ratio since then.

The economies of major tourist destinations in Japan, supported by the profits generated by foreign visitors to Japan are getting increasingly exhausted. For example, at ski resorts in Hokkaido, foreign visitors to Japan who accounted for the majority of skiers visiting ski resorts before the pandemic disappeared from the slopes there.

After the second state of emergency was issued, the national and local governments are requesting restaurants to shorten their business hours. There are less people eating out at restaurants and bars in the downtown area recently making restaurant owners to be concerned that sales will decline and they cannot maintain their business. To support bars and restaurants that comply with requests from prefectural governors to shorten business hours, Japanese government boosted a subsidy to them to 60,000 yen a day.

The impact of the pandemic is also affecting retail and consumer prices. According to the announcement by the Japan Department Stores Association, sales of department stores nationwide in 2020 were 4,220.4 billion yen, down 25.7% from the previous year and the lowest level in 45 years since 1975. The consumer price index for 2020 also fell 0.2% from the previous year, the first decline in four years, according to statistics announced by the Ministry of Internal Affairs and Communications. In particular, the index fell by 1.0% in December 2020 from the same month of the previous year due to the third wave of infection which began to become serious at that time. It was the largest drop in 10 years and 3 months since September 2010, when Japan’s economy was affected heavily by the Lehman shock.

The current situation DI in December of the Economy Watchers

Survey released by the Cabinet Office fell sharply to 35.5, down 10.1 points

from the previous month. Business conditions in the food service industry have

declined, and business conditions and employment in the non-manufacturing

industry have also deteriorated. The Cabinet Office says that the economy is

deteriorating due to the effects of the new coronavirus infection, and there is

growing concern about the future containment of infectious diseases.

The Bank of Japan’s “Tankan” quarterly survey suggests business sentiment has rebounded across the board

On the other hand, there are some bright signs implying Japanese economy is on a recovery truck. According to the Bank of Japan's latest “Tankan” quarterly survey which shows a short-term economic outlook of enterprises in Japan, business sentiment has improved sharply in December with expectations that Japanese economy is recovering from a year-long recession.

The Tankan reported rebounds in all categories, both manufacturing

and nonmanufacturing companies, large and small. The index of business

conditions among large manufacturers rose to minus 10 from minus 27, while

business sentiment among large non-manufacturers such as service industries

rose to minus 5 from minus 12. The index for large manufacturers has improved

for the second consecutive term and the extent of improvement was the largest

since the June 2002 survey.

Nikkei stock average reached 30 year’s high with tail wind of strong exports

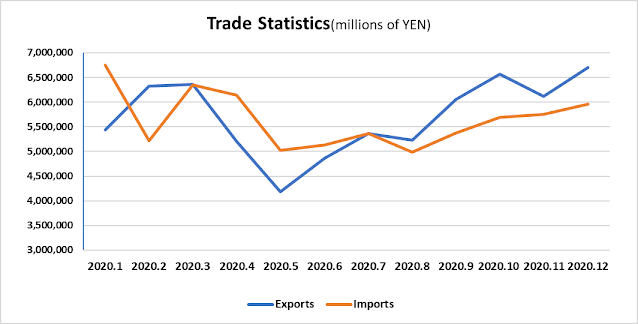

Japan's export value in December last year exceeded the same month of the previous year for the first time in 2 years and 1 month since November 2018 due to the increase in exports to China. According to trade statistics released by the Ministry of Finance, Japan's export value in December was 6,706,2 billion yen, up 2.0% from the same month of the previous year. An increase in exports of plastic and non-ferrous metal products to China and exports of semiconductor and other manufacturing equipment to Asian countries including China contributed. Last month's trade balance, which is exports minus imports, was a surplus of 751 billion yen, recording a trade surplus for the sixth straight month.

Furthermore, the Nikkei Stock Average which fell sharply in March 2020 and lost its value about 30% from its high at one point due to the corona shock, recovered strongly after that. In December 2020, it reached 27,000 yen for the first time in 30 years, and in January 2021, it exceeded the 28,000 yen level.

On January 25, Tokyo stocks rose with the

benchmark Nikkei 225 index closing at a 30-year high, amid continued hopes for

robust earnings at Japanese firms as well as advances in U.S. high-tech shares

before the weekend. The Nikkei 225 ended up 190.84 points, or 0.67 percent,

from Friday at 28,822.29, its highest closing since Aug. 3, 1990. The broader

TOPIX index of all First Section issues on the Tokyo Stock Exchange finished

5.36 points, or 0.29 percent higher at 1,862.00. Some Japanese investors expect

Japanese stocks will grow over the long term due to progress in digitization

and cost reduction because the coronavirus infection forced Japanese companies to

improve their management making them more efficient and resilient.

Comments

Post a Comment