Investing in Japan: Muto Seiko is on a recovering track driven by brisk demand in China and other Asian countries

A manufacturer of digital home electronics, automobile-related equipment and precision pressed parts

Muto Seiko Co., headquartered in Kakamigahara City, Gifu Prefecture, has been manufacturing plastic molded parts and plastic precision parts worldwide since its establishment in 1956. Muto Seiko offers plastic parts for digital home appliances, such as digital and video cameras.

It also produces center panel

units for automobile-related parts including car navigation system, air

conditioner, audio as well as molds for injection molding and presses. It has

production bases both in Japan and overseas for the company’s integrated

production system of mold design, mold manufacturing, plastic molding and

assembly of the final process. A factory adjacent to the head office in Gifu

serves as a mother factory for overseas production bases in China and Southeast

Asia.

COVID-19 pandemic dented Muto Seiko’s profits

As for the current business performance, the spread of the new coronavirus infection has caused the automobile manufacturers to which Muto Seiko supplies its products suspended their operations of factories and reduced production in last spring, resulting in a decrease of Muto Seiko’s production and sales worldwide.

Demand for some products

such as digital pens and home printers has maintained certain level thanks to

increase in teleworking, but sales in three quarters to December 2020 ended up

with 14,385-million-yen, 12.4% decrease compared to the same quarter of the

previous year. Operating income was 895 million yen, 3.5% decrement from the

same quarter of the previous year, and ordinary income was 807 million yen, a

decrease of 19.2% due to incremental foreign exchange losses.

Full year financial forecast is revised up reflecting abrupt rebound in Q3

However, those financial results are much better than that of previous forecasts announced by Muto Seiko thanks to abrupt rebounding in Q3 financial results. Furthermore, as for the full-year consolidated earnings forecast for the fiscal year ending March 2021, sales, operating income, and ordinary income are all expected to exceed significantly previous forecast although an extraordinary loss was posted in the third quarter to prepare for the cost associated with the liquidation of a consolidated subsidiary dragging financial results lower.

Reductions in fixed costs and steady recovery in demand beyond expectations in the automobile-related market will contribute to company’s financial results. In the latest forecast, sales are expected to be 19 billion yen, up 9.8% compared to the previous forecast, operating income is expected to be 1 billion yen, up 122.2%, and ordinary income is expected to be 900 million yen, up 100.0%.In

the future outlook, the acceleration of EV conversion in the automobile

industry is expected to increase the demand for plastic parts. Muto Seiko has constructed

its 5 th factory to respond to the increase in demand of automobile

parts. The construction of the its 5th factory enabled Muto Seiko to expand its

total production capacity by 30%. It is also considering introduction of

automated robots into its factories to enhance productivity by saving labor.

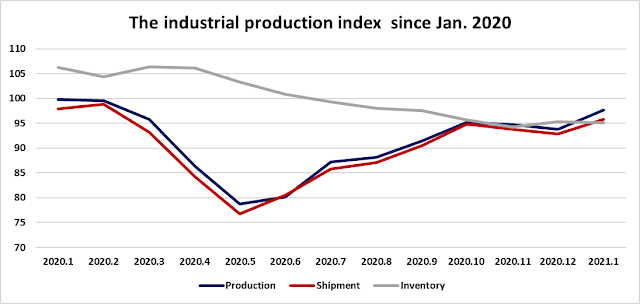

Export grew at faster pace and industrial production rose thanks to a pickup in global demand

Japan’s exports accelerated in January, led by an increment in Chinese demand turning manufacturers’ sentiment positive recently. It is viewed as a harbinger of gradual recovery of Japanese manufactures, especially the auto industry from last year’s deep coronavirus slump. Preliminary trade data from the Ministry of Finance showed exports climbed 6.4 percent in yen terms from the same month last year.

In addition, Japan's industrial production rose in January recovering to the level before the first state of emergency in last April. The index was up 4.2 percent from December. A wide range of fields show growth, including automobile bearings and semiconductors used in USB memory chips for customers in the US and Asia. The index implies an impact of the second state of emergency is less severe for manufactures than previously estimated. Core machinery orders, a volatile but leading indicator of capital spending, also rose 5.2% in December from the previous month, up for the third straight month rise, another encouraging sign for a private sector-led recovery.

Judging by recent those

indices and surveys, the Japanese government upgraded an assessment on

corporate profits in its monthly report in February for the first time in two

months as they were picking up while weakness is seen in non-manufacturers due

to the impact from the pandemic. Manufacturers’ profits have been recovering

gradually helped by rebound in auto production and 5G technology related

demand, the report implies. Muto Seiko’s sales and profits are expected to continue

bouncing back with tailwind of those favorable business environment for

Japanese manufactures.

Comments

Post a Comment