Japan's Economy: Nikkei 225 finally topped 30,000 yen for the first time since August 1990 while Toyota Motor posted highest quarterly financial results in five years

Nikkei surge reminds investors of bubble era high

On February 15, Japan’s Nikkei 225 Stock Average has finally breached 30,000 yen for the first time since August 1990, after it has repeated to hit record highs on several days in February back up through levels not seen since the collapse of the bubble economy.

Having positive outlook for the medium to long term, overseas investors who have been late to buy stocks are jumping into the market driving up stock prices. Looking at the announcement of financial results for the first three quarters of the current business year, which began in earnest in February, rebounding sales and profits of domestic companies centered on the manufacturing industry became more apparent.

The planed vaccination rollout of the new coronavirus and expectation

for continued stimulating fiscal policy are also revitalizing economic

activities and support optimistic outlook for the future business performance.

On February 12, barrage of financial results for the fiscal year ended March

were announced by Japanese companies. On this day, about 370 companies

announced their financial results for the October-December period of 2020, and

one in five companies had the highest net profit for the period. In addition to

the tailwind of strong "stay-home demand", the rapid recovery of

manufacturing industries such as automobiles improved the business performance

of a wide range of companies.

Recovering automobile industry brings auto parts suppliers with increment of their sales

Toyota Motor which reduced production by 50% in May 2020 in response to coronavirus pandemic, posted solid financial results showing clear recovery with the production volume from October to December reaching a record high for the first time in five years. Although Toyota Motor's full year business performance is expected to be less than that of the previous year, Toyota’s financial results show a rapid recovery.

According to the consolidated earnings forecast for the fiscal year ending March 2021 announced by Toyota Motor Corporation on February 10, net income, which was 1,900 billion yen, has been significantly revised upward from the previous forecast of 1,420 billion yen, 30 % decrement although it was still down 7% from the previous year. Its launching new car models such as the popular SUVs "Yaris Cross" and "Harrier" boosted Toyota’s profits.

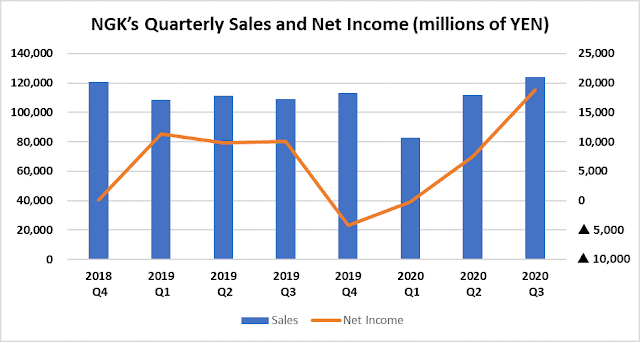

The strong performance of the automobile industry has brought other manufacturers which supplies car parts to auto industry with increment of their sales. NGK Insulators' sales of ceramics products to purify exhaust gas from automobiles increased, and net income was solid at 18.8 billion yen, up 88% from the same period of the previous year.

The profits of companies that

manufacture automobile parts such as Denso, Murata Manufacturing, TDK, and Nidec

have also improved. Although sales and profits of the automobile industry is

affected by the shortage of semiconductors, it is gradually returning to the

pre COVID-19 level. In the manufacturing industry, the factory utilization rate

fell in the first half of 2020 due to the spread of corona infection causing

the inventory level relatively restrained. However, the demand in the

automobile market rapidly recovered and the production level increased at a

stretch, generating incremental profits.

Structural reform in industries boosts corporate Japan’s profitability

In addition to these short-term business cycles, long-term changes in the industrial structure, such as the digitization of society, are also boosting corporate performance. Due to the increasing demand from people forced to stay home, the use of online shopping, home delivery services and sales of food products were expanded. Net income of Yamato Holdings Co., Ltd., a major delivery service provider, increased by 22% year-on-year, and Toyo Suisan Kaisha, which manufactures instant noodles, also increased its profits.

Against the backdrop of improved corporate performance, stock trading by overseas investors resulted in net purchases of 421.5 billion yen in Japan's major stock markets. A series of upward revisions in earnings forecasts and higher expectations for economic recovery in the United States and other countries have greatly improved sentiments of foreign investors. Strategists at Japanese security firms expect Japanese investors also improve their sentiments further from now on.

Pfizer’s vaccine will arrive in Japan on February 12, and vaccination will begin in a week or two. Although the state of emergency issued in 10 prefectures continues, the number of infected people continues to decrease nationwide, and there is widespread view that the government will lift the deadline on March 7 ahead of schedule. The scenery of "the end of pandemic" has finally appeared in the horizon.

In

addition, Japan's exports are rebounding steadily in recent months. It rose for

a second straight month in January amid strong demand from China and the rest

of Asia. Preliminary trade data from the Ministry of Finance showed exports in January

climbed 6.4 percent in yen terms from the same month last year. The cabinet office

survey also shows Japan's machinery orders for October-December grew strongly expanding

16.8 pct from the previous quarter. With those positive data announced lately,

economists expect that corporate performance will continue to recuperate in coming

months.

Comments

Post a Comment