Business sentiment hit highest although Tokyo Olympics without spectators may worsen consumer sentiment

Japan’s business sentiment rises fourth straight quarters led by exports

According to the Bank of Japan's latest “Tankan” quarterly survey released in June which shows a short-term economic outlook of enterprises in Japan, the index showing business sentiment of large manufacturing companies was plus 14 points, 9 points higher than the previous survey and improved for the fourth consecutive quarter.

The index for large manufacturers was the highest in two and a half years since the December 2018 survey. The plethora of sectors in the large manufacturing industry remained optimistic thanks to the backdrop of increasing exports accompanying the recovery of overseas economies.

For example, the index of general-purpose machinery sector such as turbines rose by 34 points and the index of electrical machinery by 28 points. On the other hand, the production of automobiles has deteriorated by 7 points due to the suspension of production at the factory due to the shortage of semiconductors, resulting in a plus 3 points.

The index showing business sentiment of the large non-manufacturers also turned positive for the first time in five quarters since the March 2020. Index for the service sector composed of large companies improved slightly from the previous survey of minus 1 point to plus 1 point.

By industry, because of the prevalence of teleworking the

index of industries such as communications and information services rose significantly

although the index for industries related to food and leisure such as accommodation

and restaurant services were minus 74 points. The index for amusement parks and

theaters was minus 31 points showing those sectors are still in a bleak

situation.

Rising prices, resurgence of COVID-19 and Tokyo Olympics without spectators may curb corporate profits

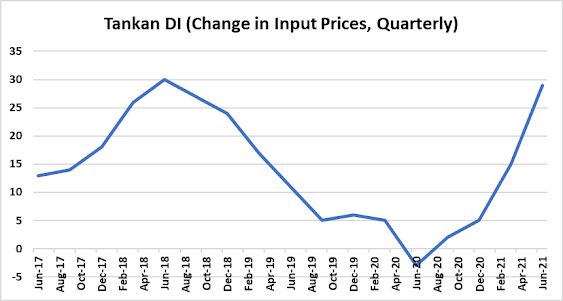

Rising raw material prices accompanied by the recovery of overseas economies are beginning to induce new ramifications. Many businesses seem to incur financial burden brought by incremental purchase costs although they cannot fully pass on those cost to selling prices.

The state of emergency to contain the pandemic discouraged consumers from buying. Business conditions are not likely to deteriorate immediately, but could continue to fluctuate as the cost of raw materials keep rising.

In addition, recent semiconductor shortages which cause another ordeal for many manufactures is unlikely to be resolved soon. Against back drop of the economic recovery and expansion of teleworking, demand for semiconductor and its manufacturing equipment, construction machinery will be strong for the time being.

Sales related to the installation of 5G stations for high-speed, large-capacity communication standard will also continue to increase. Against backdrops of those economic recovery, price increases are becoming apparent both overseas and domestically.

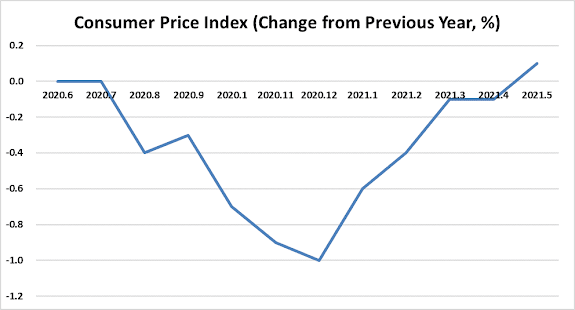

Rebounding in sales from stagnation caused by pandemic and repeated state of emergencies is expected to continue while the economic recovery proceeds as the vaccination roll out progresses. However, because Japan has been slow to recover from the economic stagnation after the new coronavirus pandemic compared to the United States and China, rising prices and cost may worsen consumer sentiment and profits of companies curbing economic recovery.

In addition, the Japanese government has announced it

will impose a fourth coronavirus state of emergency for Tokyo covering the

duration of the Tokyo Olympics, which has prompted Olympic organizers to ban

spectators from venues. That may cut private consumption by 1.2 trillion yen, some Japanese

economists are concerned.

Comments

Post a Comment