Investing in Japan: Toyota lifts profit forecast for FY 2021 despite pandemic’s supply chain damage

Toyota has demonstrated greater flexibility in adapting to supply chain disruptions

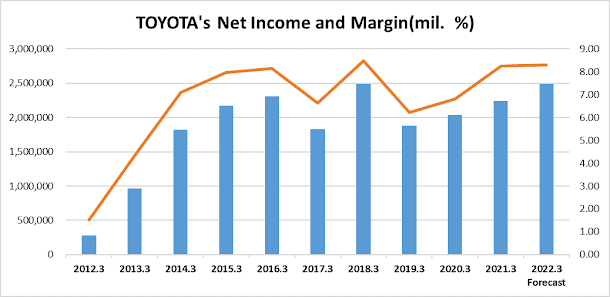

Toyota Motor Corporation is a Japanese automaker which investors around the world admire its strong business profile, the highest margin in its peer group and resilient credit metrics that provide significant downside resiliency.

Even Toyota is facing difficult business conditions this year such as a shortage of semiconductors forcing Toyota to reduce its production and rising raw material prices, the new coronavirus infection’s lingering effects.

However, Toyota has managed to revise its earnings forecast for FY 2021

upward by securing higher than expected profits through strengthening sales of

profitable SUVs, efforts in rationalization and the tailwind of the

depreciation of the yen. Toyota has demonstrated greater flexibility in

adapting to supply-chain disruptions since the beginning of the Covid-19

pandemic, which resulted in a continuing advantage for Toyota when supply normalizes.

Toyota Motor Corporation's interim results for the entire group from April to September reached record highs in both sales and profits due to increased sales in the United States and other countries, raising the outlook for profits in FY 2021.

Toyota Motor's sales increased 36% from the same period of the previous year to 15,481.2 billion yen, and the final profit was 1,524.4 billion yen, about 2.4 times of previous fiscal year’s profit. Furthermore, the final profit forecast for the current fiscal year has been revised upward from 2.3 trillion yen to 2.49 trillion yen.

Although many automakers continue to struggle with microchip shortages and supply chain issues, Toyota said it expects to return to full production before the end of the year.

Even in the EV field, although Toyota seems to have been hesitant so

far to proceed with large-scale EV production because of mighty Toyota’s market

leadership and extensive R&D in hybrid-electric drivetrains that use

nickel-metal hydride battery packs, Toyota has now been steadily gearing up its

EV strategies to compete, responding with its own line of battery EV models.

Rising prices may hinder Toyota’s profit growth

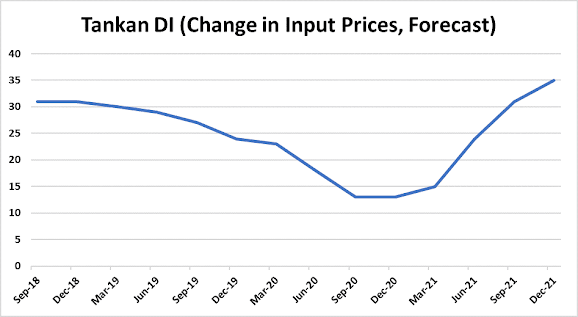

On the other hand, regarding the outlook for coming quarters, Toyota said that soaring prices of raw materials such as iron and aluminum could put persistent pressure on profits. The corporate goods price index, which is an index showing prices traded between companies, was 107.8 in October 2021 against the level of 100 on average in 2015, the highest in 35 years and 8 months since February 1986 when Japan entered the bubble economy.

The producer price index rose at rate of 8.0% in October. Rising prices in gasoline and diesel fuel caused by soaring international crude oil prices strengthened inflationary pressures on Japan’s economy.

As economic activities of countries around the world which had been stagnant due to the spread of coronavirus infection have normalized, the prices of steel, synthetic rubber, copper, aluminum and other materials have risen widely.

The producer price index has surpassed the same month last year for eight consecutive months, with an increase of 8.0% last month, the biggest gain since January 1981 when crude oil prices soared amidst the second oil crisis.

The Bank of Japan's quarterly "Tankan" business survey showed more companies facing higher input costs although Japan's inflation is still modest by global standards. Surging raw material costs have made it almost impossible for firms in Japan not to pass on wholesale price hikes, but they have typically resisted to do so for fears of losing their business.

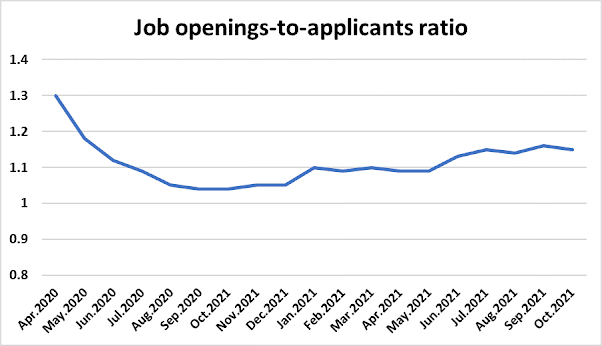

In addition, labor cost is expected to increase as employment situation is improving and Prime Minister Fumio Kishida expressed hope that companies will agree to increase wages by over 3% during “Shunto” wage negotiations next spring.

The Bank of Japan has stated that it will keep an eye on the impact of rising prices, as rising prices will further squeeze the profits of Japanese companies that were already hit hard by the COVID 19 pandemic. The Japanese government also said that it will continue to closely monitor the impact of price movements on Japan’s economy and financial markets so that the government provide needed support to households in financial difficulties and companies suffering from energy price.

Comments

Post a Comment