Booming Chubu economy; Toyota increases investment, IBIDEN strengthens the production capacity

IBIDEN builds a new factory to increase production capacity for high-end IC substrates

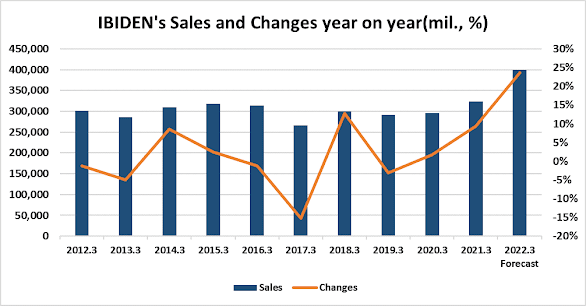

Economic activity of semiconductor-related industries in the Chubu region is booming thanks to the growing global demand for semiconductor chips. One of those company is IBIDEN, a major semiconductor packaging provider located in Gifu Prefecture which posted a significant increase in sales and profits in the interim results for the first half of FY 2021.

Ibiden forecasts its sales for FY 2021 will increase about 24% year-on-year. Its electronic sector earned 60% of the company’s profit. To take advantage of the tailwind for semiconductor market, IBIDEN will invest 180 billion yen to build a new factory and increase production capacity for high-end IC substrates for applications such as servers and image processing units.

IBIDEN schedules to start full production at the new plant in the fiscal year ending March 2024. A package board is a product that connects an IC chip and a printed wiring board while also protecting the chip, transmitting information from the chip to other parts.

In particular, IBIDEN specializes in high-end IC substrates used in data servers and personal computers. Demand for the company's products made by stacking micron-thick insulating resins is growing due to advances in cloud technology and faster communications urging IBIDEN to expand its production base.

IBIDEN is already expanding production capacities of other plants in Gifu prefecture making IBIDEN’s investment amount to exceed 300 billion yen including the investment plan announced this time.

However, IBIDEN management considers these investments are still not

enough to meet the expanding demand for semiconductor products it provides. For

this reason, IBIDEN is planning to acquire 15 hectares for a factory land in

Gifu prefecture to build a new manufacturing base for package substrates.

Semiconductor industry in the Chubu region is booming thanks to the growing demand for semiconductor chips

Japan Material Co., Ltd., which provides

special gas, chemicals and liquid crystal used in the plants manufacturing

semiconductor started a new business to dispatch specialized human resources to

semiconductor factories and support the business expansion by semiconductor

manufacturers. Since the labor shortage at semiconductor manufacturers which

are its main customers are extremely serious, Japan Material dispatches human

resources with specialized knowledge though extensive training to manufacturers’

production site.

Companies in the Chubu region that engage in manufacturing ceramic products such as NGK Spark Plug, NGK Insulators, and Noritake Company Limited are also taking advantage of the booming semiconductor market.

NGK Spark Plug Co., Ltd. manufactures parts for semiconductor manufacturing equipment called electrostatic chucks that fix silicon wafers by the force of static electricity and semiconductor packages that protect IC chips.

NGK is engaged in manufacturing semiconductor equipment parts with improved heat resistance by utilizing its own ceramic technology and it started operation at a new factory in 2019 that manufactures semiconductor manufacturing equipment parts in Gifu prefecture.

Noritake Company Limited is also

developing new semiconductor technologies and materials related to vehicle

electrification and next-generation communications.

Toyota Motor increases investment on eco-friendly next-generation vehicles such as EVs

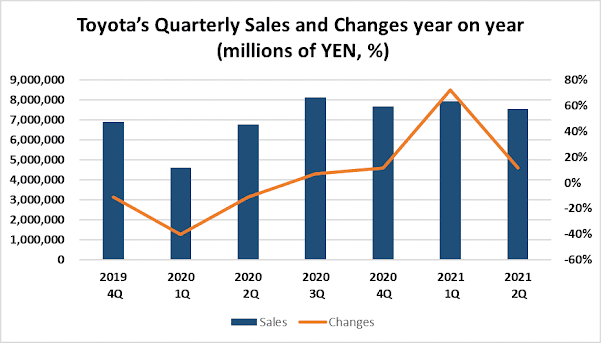

Toyota Motor posted solid sales for the July-September period of 2021 with an increase of 11.4% year on year. Toyota Motor plans to restore production to the level before the pandemic so that it can achieve the production target of 9 million units in the fiscal year ending March 2022.

Toyota was forced to cut production by 40% compared to the company’s plan due to the stagnation of parts supply after the new coronavirus infection spread in Southeast Asia although the range of production cuts has been reduced since November.

Toyota management said at a press conference on November 4 that the

risk of spreading coronavirus infection and semiconductor shortages was

significantly reduced recently. Toyota's production in September-October

dropped to about 500,000-600,000 vehicles, but it is planning to produce

850,000-900,000 vehicles in November and 800,000 vehicles in December.

Toyota Motor now focuses on the development and manufacture of eco-friendly next-generation vehicles such as hybrid vehicles, electric vehicles and hydrogen fuel cell vehicles. While building a battery plant in the United States for electric vehicles, whose demand is expected to increase coming years, it continues to utilizes its technologies for combustion engines by participating races for hydrogen engine vehicles.

Toyota is forecasting the sales of electric vehicles in 2030 to sell 8 million units worldwide including HVs. Of these, EVs and FCVs that do not emit carbon dioxide account for 2 million units. Since batteries required for EVs will be about 60 times that of HVs, Toyota has announced plans to invest 1.5 trillion yen by 2030 to increase battery production for those vehicles.

Toyota plans to start a new project in the United States jointly with Toyota Tsusho to set up a new battery plant there while proceeding with the development of hydrogen engines by its own. In production of the hydrogen engine, technologies used for the existing engine will be utilizes and can be applied to commercial vehicles.

However, there are a plethora of problems to be solved such as lack of hydrogen

supply networks and storages so investors are paying attention to how Toyota

will deal with these issues.

Comments

Post a Comment